Review of FY2023 and Future Outlook

Halfway point of our medium-term management plan marks a groundbreaking year

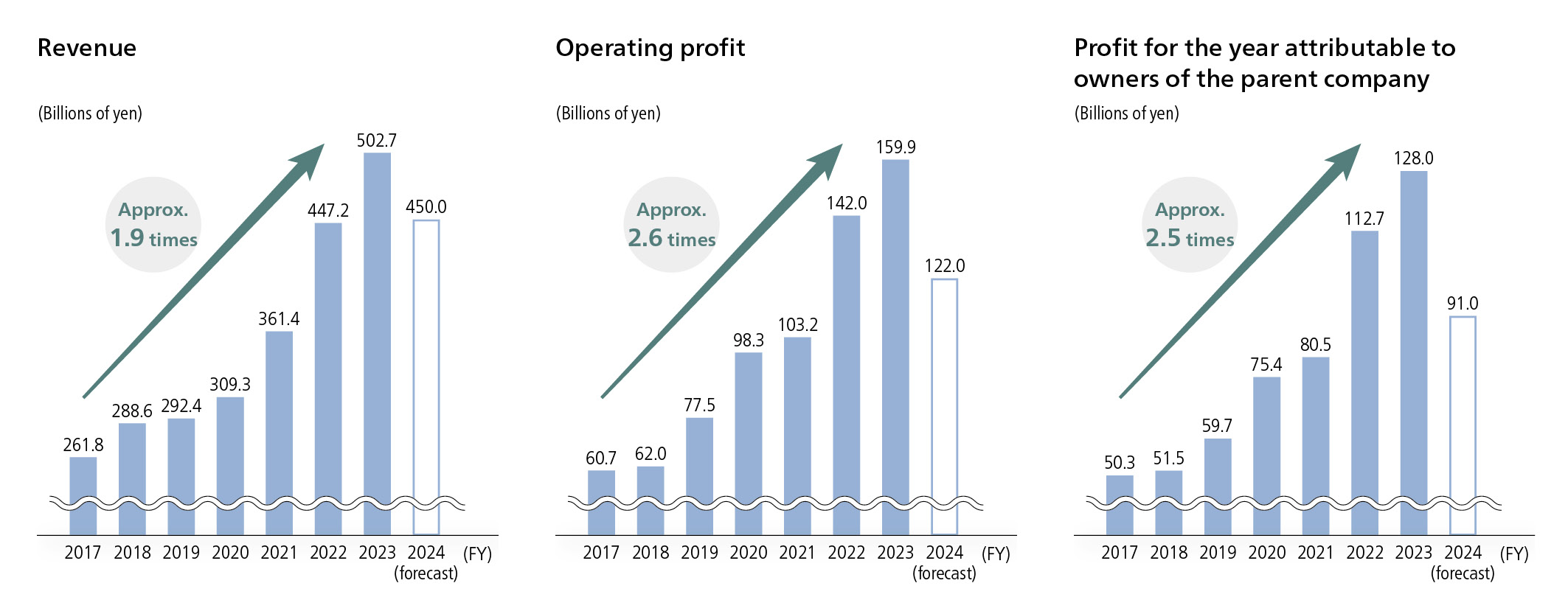

In FY2023, our revenue exceeded 500 billion yen. This is the first time since our founding that this has happened, marking a significant milestone. Additionally, operating profit reached 159.9 billion yen, with profit for the year also reaching a record high of 128 billion yen. Revenue has increased for nine consecutive terms, with six consecutive terms of profit growth, both indicating solid business performance. Of these, we consider it particularly significant that our R&D investment exceeded 100 billion yen for the first time, which we consider our most important benchmark. Our medium-term management plan targeting FY2031 calls for annual R&D expenses of 200 billion yen, and this requires revenue to reach the 1 trillion yen level, calculated in reverse. We assess that we have reached the midpoint of our 15-year medium-term management plan, which started in FY2017 and ends in FY2031, and as such are halfway to meeting out targets.

In forecasts for FY2024, we expect a decline in both revenue and profit due to NHI price revisions, reduced royalty income,and the absence of one-time income from the settlement of a patent-related lawsuit. However, we will continue to invest over 100 billion yen in R&D and steadily work on the “maximization of product value” to overcome these difficult times, and to pave the way for further growth.

Turning the challenges of increasingly harsh environments into opportunities

The environment surrounding the pharmaceutical industry is becoming increasingly harsh. Global pharmaceutical companies and bio-ventures have been engaged in drug discovery for a wide range of diseases for a long time, and accordingly, the areas with unmet medical needs are narrowing. The remaining areas involve treatments for high-difficulty diseases, with drug discovery itself becoming more challenging. With the cost of generating each drug rising every year, this means the hurdles for new drug development are extremely high. Furthermore, the economic impacts of NHI price reductions due to the NHI drug price scheme are posing challenges. The pharmaceutical industry is therefore facing an environment in which it must continue to work on new drug development under extremely difficult conditions. However, this situation was anticipated during the formulation of our current medium-term management plan.

It is precisely because we are in an era of rapid environmental change, that it is crucial for us to return to our core purpose—the reason we conduct business. No matter how the environment changes, we will continue to base our business activities on a patient-centered approach. Rather than merely lamenting the situation, we should instead use it to consider how we can provide value to patients, and adapt to the significant changes to come.

How Do We Become a Global Specialty Pharma?

Our long-term vision is to deliver innovative new drugs worldwide as a Global Specialty Pharma. The prerequisites for achieving this are to first enhance our pipeline to ensure a rich supply of new drug candidates. Only once we have this, we will be able to continuously produce innovative new drugs.

Another prerequisite is accelerating our global expansion.Currently, we primarily conduct business in Japan and sell our own products directly in South Korea and Taiwan, but we are aiming to establish a direct sales system in the United States and Europe. To this end, it is necessary to activate open innovation during the research and development stage, and the management team must support research by in-licensing drug candidates and medicines to enhance the pipeline, as well as conducting mergers and acquisitions. Currently, there are approximately 5,000 bio-ventures in the U.S., but this is a highly dynamic environment with 2,000 being founded and 2,000 shutting down each year. With regard to M&A, Corporate Development & Strategy and a team stationed in the U.S. are constantly exploring venture companies and drug candidates worldwide, particularly in the U.S. Additionally, a separate team managing Ono Venture Investment Fund I, L.P., a corporate venture capital fund established in California, is also conducting a separate search.

For several years, we have been keeping a close eye on U.S.company Deciphera Pharmaceuticals, which we acquired in June 2024, focusing on its promising pipeline as well as it having its own sales organization. About a year ago, we listed it as a specific candidate and conducted due diligence within one to two months after entering negotiations, and we feel that having observed the company for several years allowed us to make appropriate decisions in a short time. Deciphera is currently looking to add indications to its new drug QINLOCK, and toward other compounds’ applications, approvals, and sales. Meanwhile,we have other projects underway, including the development of ONO-4059 (VELEXBRU tablets), and so Deciphera will maintain a certain degree of independence in business operations for the time being in order to focus on tasks at hand.

Key to global expansion is our talent strategy

Our talent strategy is a top priority in our company-wide efforts in promoting global expansion.

We are not yet experienced in dealing with the laws and regulations of each country and region into which we are entering. Securing talent with sufficient skills and experience here means that we must both nurture internal talent and recruit externally, just as how we approach drug candidates. In particular, while we urgently need to hire motivated and competent local staff in the U.S., our brand recognition is lower than that of major U.S. pharmaceutical companies.

Accordingly, our local staff have been working hard to post recruitment ads in various media.

Additionally, to attract as many excellent talent as possible, we relocated the office of our U.S. subsidiary, ONO PHARMA USA, INC., to Boston,which has a rich pool of healthcare talent.

Recruitment for positions necessary to establish our own sales and medical structure is progressing, and we have gradually become able to hire talent that meet a certain level.

However, the common U.S. mindset of changing jobs every three years presents a challenge in terms of retaining talent. It takes over ten years to develop a single drug, and the turnover of talent every three years creates many challenges in terms of a talent strategy that we are working to overcome.

Realizing our growth strategy leads to securing and developing talent

We are promoting diversity in our management positions with three pillars: young talent, career hires, and women. In promoting young talent to management positions, we have partially abolished the seniority-based system. We are also seeing an increase in mid-career hires in management positions. However, we previously hired few women, resulting in a shortage of women in the appropriate age group who can take on executive positions, leading to delays in addressing this issue. The current ratio of female managers is 5.8%, and we have set goals to increase it to 10% by FY2026 and 20% by FY2031, the final year of our medium-term management plan. We are increasing recruitment of women, and if the current employees in the age group up to 40 make steady progress through training programs and continue to develop, we expect to achieve a 20% ratio by FY2031. In addition to various training programs aimed at developing skills and promoting younger employees, we have established a training system aimed at fostering diverse viewpoints, such as an internal job challenge program allowing employees to concurrently work in other departments. Also, in addition to classroom learning, we also provide employees with opportunities for hands-on experience, such as one-year secondments to a venture company, or an overseas assignment.

With the working population set to shrink further, we must communicate that joining our company offers attractive work opportunities, not just competitive salaries. Failure to do this may result in difficulties in securing even the minimum required workforce, let alone attracting top talent. We believe that supporting employees’ challenges and providing opportunities for growth as well as creating an environment in which a diverse group of people can work with enthusiasm will achieve the goals of our medium-term management plan and generate profits, and that providing a good return to employees will help us continue to secure and develop talent in the future.

Driving strong growth with a three-executive representative director structure

From FY2024, we transitioned to a three-executive management system, with President Takino, Executive Vice President Tsujinaka, and myself as Chairman, all holding representative rights. As we welcome the halfway point of our medium-term management plan, patents for various products including OPDIVO will begin to expire. This will lead to a more challenging business environment in the latter half of the management plan when compared to the smooth progress experienced so far. Overcoming these challenges requires that we strengthen our global expansion. Given these circumstances, we decided that expanding leadership from one key person to a team of three would allow us to drive the management plan more effectively, hence our decision to implement the three-executive structure.

In fact, when I became president in 2008, the situation was somewhat similar. Within three to four years, the patents for 90% of our products in terms of revenue were facing expiration. Given that we had no product candidates near launch in the research labs, we had no choice but to acquire them from outside the company, and so I asked the business development department to acquire three drug candidates that would be ready for launch within three years, and I also traversed the world searching for new drug candidates. The person who was with me in this frantic search was now President Takino.

Although we did not meet our three-year target, we managed to acquire a significant number of drug candidates over five to seven years. The success of OPDIVO, which undoubtedly seemed uncertain at first, came six years after I became president in 2014. The success of OPDIVO started with a struggle and came after 15 years of everyone toiling together.

Although I have stepped down as president, I will continue to be involved in overall management strategy decisions as CEO, while also handling external negotiations and providing support to various departments. With President Takino, who has extensive overseas experience and has been involved in drug discovery, leading internal operations, and Vice President Tsujinaka focusing on a talent-based management foundation, I believe we will be able to steadily advance our global strategy.

Carrying on from Our 300-year History, Using the Success of OPDIVO to Drive Further Growth

I am Toichi Takino and I was appointed President and COO in April 2024. ONO is now over 300 years old, and is continuing the long legacy built by our predecessors, and so at this juncture where we are poised to assume our place on the world stage, it is with a sense of determination that I assume the mantle of President. Being very fortunate to have had the opportunity to generate OPDIVO, a product that has become a representative of the industry, I am firmly committed to ensuring that this momentum translates into our next phase of growth.

While there is undoubtedly a focus on the impending expiration of OPDIVO’s patent, much attention is also being paid to the challenges of how we will generate future products and secure revenue streams. We are indeed urgently working to overcome these challenges, but taking a different perspective, the success of OPDIVO has also presented us with even more significant opportunities for growth. Based on the success of OPDIVO, we are creatively preparing and executing strategies for our next phase of growth, making this an incredibly rewarding and exciting period of time for our company.

Vigorously Promoting a Major Transformation of Our Business Model under the New Structure

We have now reached the midpoint of the 15-year medium-term management plan spearheaded by Chairman Sagara. At present, put simply this phase marks a stage in which we are transforming from a business model primarily focused on the domestic market and relying on overseas partnerships, to one centered on direct sales in the U.S. and Europe. In the past, we lacked the strength to take on such challenges, but now the Company has finally grown to the point where we can tackle this transformation of our business model.

Additionally, I believe that our delayed response compared to our competitors has actually turned out in some ways to be beneficial. In other words, observing the global expansion of other companies has increasingly highlighted the importance of having multiple product candidates, not just a single product, when entering international markets. We are taking this into account in our current efforts in expanding into the U.S. and Europe.That is, it is necessary to strengthen our secondary and tertiary strategies simultaneously, and I believe that the new three-executive structure fit perfectly with the advancement of these measures in parallel. At present, we are the stage of shifting to a structure to robustly promote our growth strategy of expanding our direct sales in the U.S. and Europe.

Aiming to enhance our secondary and tertiary strategies

Our evaluation of Deciphera Pharmaceuticals, a U.S. biopharmaceutical company that we acquired in June 2024, was also because this enhanced our secondary and tertiary strategies. A major reason in this decision was that the acquisition was not just for a single product but also included a second product in the preparation phase for the application for its approval, as well as several early-stage drug candidates.

Our product candidates in global development include ONO-4059 (VELEXBRU tablets), which is already marketed in Japan, and Itolizumab, for which we have obtained an option from Equillium in the U.S. While there is a slight gap in development stages between these drugs, we have around 10 projects in the early stages of development from our own drug discovery efforts. We are working tirelessly to compensate for this unbalanced pipeline with products and product candidates from Deciphera, while also leveraging to the fullest extent possible their drug discovery capabilities to accelerate our group’s research and development. Our aim is to bring to market (sell) as many of these candidates as quickly as possible, and by achieving multiple product launches in the U.S. and Europe, hope to make new drugs available to even more patients.

Leveraging Our Experience to Drive Global Expansion and Grow Our Pipelines

Among the four growth strategies we have set forth, based on my past experience I want to push forward the most are “Promoting Global Expansion” and “Pipeline Expansion.” In particular, I am doing everything I can to maximize the value of Deciphera Pharmaceuticals as a Group company. I believe that by effectively utilizing Deciphera, we can accelerate and strengthen our ongoing efforts in pipeline expansion.

Considering the vast throng of competitors, the past experiences of other companies shows us that expanding globally is no mean feat. However, there is no need for pessimism. Through OPDIVO, we have accumulated significant expertise in oncology, as well as know-how in open innovation and licensing arrangements with other companies. I believe we can establish our unique presence in global markets as well, by utilizing our unique perspective and relationship-building skills, and collaborating with venture companies and academia. Rather than feeling daunted, I am actually very excited about the prospect of tackling new areas.

Dreaming of the day our mission “Dedicated to the Fight against Disease and Pain” resonates worldwide

Domestically, in recent years we have increasingly heard comments such as “ONO’s business has an impact on society” and “Your company is growing,” giving us more opportunities to feel that we are contributing to patients. We hope that we can achieve similar name recognition in local markets as we work to expand our direct sales in the U.S. and Europe. It would be truly remarkable if the day comes when we are recognized as a company indispensable to society even overseas, through our generation of innovative drugs.

To make this vision a reality, we first need to realize our corporate philosophy, “Dedicated to the Fight against Disease and Pain,” in the United States and Europe. We would like to see a situation where, as a result of our global activities across all functions—R&D, manufacturing, quality, safety, medical, sales, supply chain, management, and governance—we are able to deliver new drugs or new treatment options to patients worldwide, from Japan and Asia to the U.S. and Europe, and get the real sense that we are having a meaningful impact. It would be ideal if such a situation could instill pride in our employees and their families.

Harnessing the Diverse Internal Strengths and Wisdom of the Outside World to Generate Breakthroughs

Ultimately, what supports our growth strategy are each and every one of our employees, who represent the very essence of our company. This is reflected by the fact that, in recent years, human capital has become an important intangible asset. For us, pipeline enhancement and global expansion both rely on our people, and they are the ones who drive the Company forward. Therefore, we try to provide a solid corporate structure upon which every employee has opportunities to grow. Additionally, we must focus on fostering an organizational culture and environment that enables each employee who has grown to effectively demonstrate teamwork. In this sense, I would hope that our company embody the ancient Chinese saying, “The best plan for a lifetime is to cultivate people.*”

Years ago, I traveled the world with Chairman Sagara in search of drug candidates with the aim of expanding our pipeline, a mission we accomplished thanks to both his leadership and support, and the collective effort of everyone in the company. These days, it is said that diversity is key to organizational strength. To me, diversity means harnessing the power of bottom-up approaches, as the era of top-down leadership has passed. This is because, in this day and age, it is increasingly important to be able to skillfully integrate specialized information from various fields. Given that we are now in an era where it is impossible to generate new drugs without gathering ideas and opinions from experts in various fields, I think that the leaders of today must listen to those who best know the field and technologies and ensure that they have the opportunity to excel.

Given that research and development tends to be inward-looking, we need to be conscious of this and make use of external wisdom. Both prostaglandins and OPDIVO were born from open innovation, and collaborating with external partners in R&D remains our greatest strength. I am confident that our company has the foundation to continue leveraging this strength to generate the next innovation or make breakthroughs. Looking forward, we would like to incorporate as many ideas as possible from those who know their respective fields best, and connect them to our drug discovery and business activities.

* The source is the ancient Chinese book “Guanzi.” The full text is “The best plan for a year is to plant grains; the best plan for ten years is to plant trees; the best plan for a lifetime is to cultivate people,” meaning that prioritizing human resources is the best way to plan for the future.